[INCOMING CYCLE HITS IN]

Insider Report Reveals:

Next Major Turning Point

In The Gold Markets

This Is How You Can Massively Profit From These Dates

From The Desk Of Andrew Pancholi,

The Market Timing Report,

London, UK

Hi, this is Andrew Pancholi…

I want to share something with you today:

Write this date down:

The Week Ending 14th March, 2025.

I’m calling it “The Next Significant Wave” turning point in the Gold market and you could make some great financial moves in the coming weeks and months by taking advantage of this cycle…

You see, if you’ve been following my work over the past decade through several publications, including Traders World Magazine, FXStreet or Real Vision or prominent names like NY Times Best Selling Author Harry S Dent Jr, then you will know I'm the go-to resource for fund managers and institutional investors when they want to find out when the market is going to turn….

A handful of major multi billion dollar hedge funds have been using this proprietary knowledge HIGHLY successfully with incredible results. I have been speaking with some of these clients since the late 1990s.

Having investigated cycles for many years, we made a breakthrough discovery that enables us not only to identify when markets are likely to change trend, but also differentiate between smaller and larger moves.

The Market Timing Report has helped a very small elite group of traders make truly life-changing investment gains…

And today, I want to give you access to that EXACT information that has only been available to elite institutions and traders “in-the-know”.

Talking television heads & “investment gurus” say that markets cannot be timed.

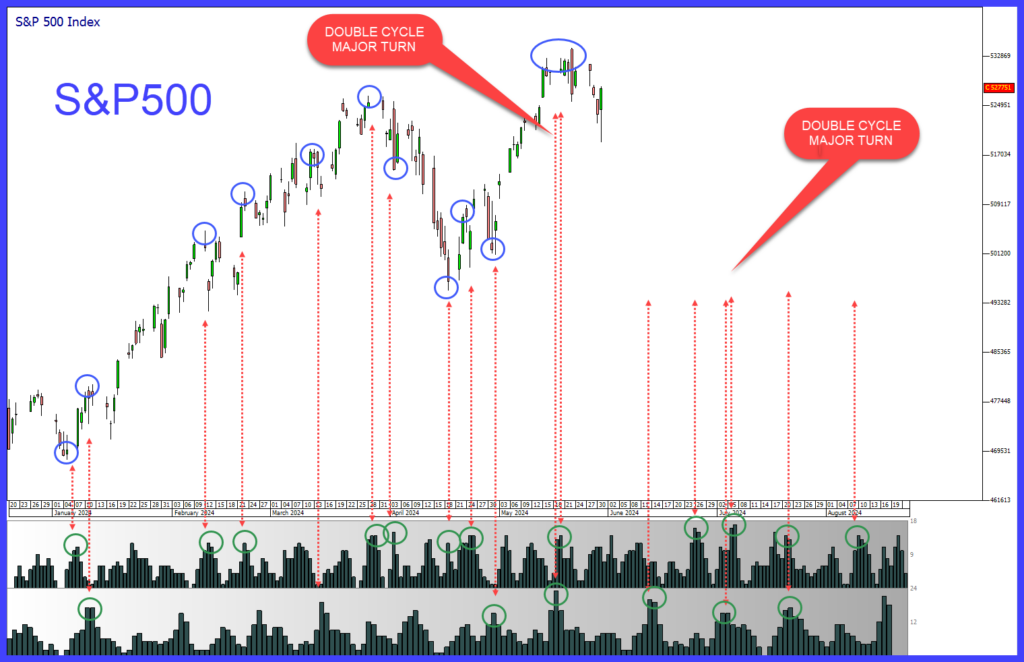

But take a look at this chart of the Gold market below:

Below the chart are spikes.

These are not volume bars.

You can see that when they peak, the market changes trend.

See how it has happened in the past.

The arrows show you where the histograms peak and see how the market turns!

But most importantly we can see likely FUTURE TURNING POINTS.

These histograms are derived from The Market Timing Report System. There are similar cycles and other dates across a range of markets including the S&P 500 Index.

They work in different time frames.

In the chart above you can see where the longer term turns are likely to the place.

Below you can see where these can be fine tuned into daily turning points.

Again see how the tall spikes in histograms pick out daily turns.

This time you will see two rows of histograms.

These are two different predictive cycle sets.

These highlight some of the short term ‘daily' turning points.

And by the way, here are the longer term turning points for Crude Oil 2007 to 2027

- Would this information be useful to you?

- How would knowing when the markets are likely to turn enhance your trading system?

- How different would your financial situation be if you could time markets?

How You Can Use This Information to Enhance Your Trading & Investing

- You Are Forewarned, Therefore, You Are Forearmed

If you are a fundamental trader and believe something is about to happen, then our longer term cycles as well as our daily cycles can help you fine tune when that event may potentially occur.

To illustrate how far we can go – we are already seeing a colossal turning point in the S&P500 in 2072 (warn your grandkids)!

- Seasonality Becomes Your Friend

Many successful traders use seasonality. There are clear trends that the professionals know about and use very successfully.

Traders and investors who understand annual seasonal probability are already at a great advantage.

Many millions and indeed billions are made using seasonality and we harness this.

However seasonality doesn't always work!

If you are expecting a move to begin AND there is a Market Timing Report cycle date at that time, there is a greater probability of the seasonal move occurring.

When our proprietary cycles coincide with seasonal turns we have very high probability set ups. Conversely, if we know that a seasonal turn is coming up yet we do not have any cycles coinciding, then there is a high probability that this will fail.

This additional information improves accuracy remarkably.

- Finally Get Trend Following Right

In Jack Schwager's classic book “Market Wizards” legendary traders and fund managers such as Paul Tudor Jones, Ed Seykota, Jim Rogers and Richard Dennis share their secrets.

A common theme can be seen.

Many of these billionaires are trend followers.

Trend following is one of the most profitable ways of making money.

Michael Covel confirms this in his book “Trend Following, How Great Traders Make Millions in Up or Down Markets”.

Most trend traders place stop losses above or below the previous swing highs or lows.

They eventually get stopped out of the trend but in doing so give back a large part of their profits.

Some trend traders place stops two swings back.

This often helps you remain in the trend, but when the trend does eventually end, a substantial amount of potential profit is LOST.

The challenges with trend following revolve around identifying the beginning of a trend.

You also need to know when it's going to end.

Hence, the benefits of knowing when a trend is likely to change are massive.

The Market Timing Report highlights when trends are at risk, well in advance.

This enables you to cash in profits before swings are taken out or manage risk more effectively.

If you are a portfolio manager you can hedge positions a lot more effectively if you have a time window. This information is also critical for an option trader.

Of course, this timing can also give you an advantage for trading campaign ENTRY – especially when combined with your own systems.

- Supercharge Your Technical Analysis

Timing can really enhance technical analysis.

Many of you use Fibonacci retracements.

But how do you know which level is going to hold?

Is it going to be the .382, the 50% the .618 or the .786?

How often have you got out at a level only to see that you missed out on a ton of profit? How often have you stayed in too long, watched the market bounce and see your profits wiped out?

If you know where the time cycle is coming in then you are more likely to be able to know which level will hold.

- Unlock The REAL Data Behind C.O.T. Charts

‘The Market Timing Report' is excellent when used in conjunction with ‘Commitment of Trader Data'.

COT data breaks down positions held by hedgers, large speculators and small speculators. Careful analysis will identify trends developing. But it can't tell you EXACTLY WHEN the move will occur.

It just gives you a directional bias.

This is where ‘The Market Timing Report' will give you the edge.

However...

Our Report is Not For Everyone

Regardless of whether you are a fundamental trader or a technical trader, the timing of trade entry is absolutely critical to your profitability.

After more than 20 years of research and study of cycles, our proprietary software system generates turning points in different time frames.

This is a complex process.

The purpose of this monthly letter is to provide you with an overview of critical time zones when trend changes are highly likely.

You do not need to worry about the complexity as we take care of this for you.

For the most part trend changes are reversals but from time to time accelerations can occur. We also combine this with seasonality – a powerful and commonly used system. We enhance this with our proprietary forecasting models.

We are not infallible – inevitably a very small percentage of these turn points fail or displace by a bar or two – but we do believe that this information, especially when combined with your existing techniques and risk management, can give you a VERY SIGNIFICANT EDGE.

This research looks at very many aspects of forecasting and we leave no stone unturned.

Our super macro cycles go back thousands of years.

Believe it or not – present day economic events are forecast from cycles over the few last centuries.

What is The Market Timing Report?

The Market Timing Report:

- Focuses on S&P 500, Crude Oil, Gold, EURUSD, Dollar Index and Bitcoin

- Published monthly

- Provides high probability turn points

- Highlights macro monthly and weekly turning points which are beneficial to investors

- Highlights daily turning points which help shorter term position traders identify individual days when markets are likely to change trend

- Of course, when a daily turn point lines up within a weekly time window, you have a high probability change in trend!

- Shows high probability seasonal set ups - and when these tie up with our daily turn points, high probability turns can take place

- Shows high probability directional move days

- All information is derived from the Cycles Analysis “Profit Finding Oracle” Program

- Is based on seasonality, cycles and other proprietary methods

- We periodically look at geopolitical trends - our readers were forewarned about forthcoming massive change in the USA four years ago! It is deeply evident now.

- For those of you who want to laser guide their trading & investing with market timing, we also offer The Market Timing Report Trading Course as well as our Professional Traders Platform with Commitments of Traders Data, Seasonality, and FX Turning Points

Here's My "ZERO RISK" Promise To You.

For a limited time period only, I’m making a special promotional offer. I want to get our letter out to the public, so people can see for themselves the remarkable results of The Market Timing Report.

Historically, we have only provided this information to major hedge funds, banks and institutions for five-figure sums.

Specialized information of this nature, derived from our highly proprietary software system, is incredibly valuable and has already proven to be worth tens of millions to our professional institutional clients.

But you are not going to pay an institutional level 6-figure fee for The Market Timing Report.

In fact, you won’t even pay a four-figure sum for this powerful information.

If you act today, you can take advantage of my limited time introductory offer and get our revolutionary Market Timing Report for only $149 per month.

We continually raise prices—in fact, the subscription cost of The Market Timing Report has gone up 15 times within the last few years.

I will not hold the price at $149 a month for very long, as we will soon add more research points to The Market Timing Report to further enhance its accuracy, and the price will increase to $250 a month.

We are only offering a limited number of subscriptions at this price level for now – after all, we want our subscribers to benefit massively and in order to do this we don’t want to flood the market.

So act today to join the “inner circle” of The Market Timing Report subscribers who benefit massively from what is coming up ahead.

I realize this may not be for everyone. We only want to create successful traders who can use this information to enhance their existing systems.

So I am going to take ALL THE RISK and want to offer any new subscribers a full NO QUESTIONS ASKED 28 MONEY-BACK GUARANTEE. If you don't like what you read, just send us a message, and we will immediately refund you in full, no questions asked.

You have nothing to lose.

Subscribe today for only US$ 149.00

Remember that we offer a full 28-day refund guarantee, so it’s a risk-free purchase!

You will receive an email with the access link immediately upon ordering.

What our members

are saying

Position Strategically Before the Markets Turn

I have been a follower of Andy’s cycle analytics for many years and I find them very helpful in positioning my portfolio in the markets. The 90 year cycle has been very important, especially given the longest bull market in history and the fact that the ‘elastic band of the markets’ was already very stretched, and Andy’s work enabled me to remain alert get mainly into cash before the markets turned. Knowing when cycles are likely to occur is essential trade decision assistance information and part of a balanced approach to the markets. Thanks for your knowledge and your great work Andy!

John Morris, FX Blue

The Best System I’ve Ever Seen for Trading Success

I have followed Andy’s work for 18 months now and I am astounded by his knowledge of the markets, in particular the analysis of economic cycles. It has completely changed my outlook on trading for the better, from the analysis of the charts to the execution of the trade. I now use a combination of market cycles, chart geometry, Andrew’s Pitchforks and Commitment of Traders data. I feel that I have much more probability on my side, which is the aim of the game! The MTR Trading Course is the best and most executable system I have ever seen. I have made significant returns with safe risk management.

Dr Richard Malloch

From Frustration to Financial Success

I wanted to share with you and your team the success that I’ve been having since implementing your system and your Market Timing Report. I’m very thrilled to share that over two days, I paid for your entire course and one years subscription through commodities trading and following the system. It was huge! However, it doesn’t end there. Through your risk mitigation strategies, I was able to protect myself when the market turned a few months later. It was a game changer that previously would’ve sunk me. As a beginner in the trading realm, I’ve only ever had bad outcomes and muddling through which resulted in losses after losses. So, I stopped trading in frustration. However, your trading system and your monthly reports (plus words of wisdom) have enabled me to take control of my trading and investments. I highly recommend your course, your system and your market trading reports to those who are serious about taking control of their financial success.

Ketan Ladva, Vancouver, CA

The Most Accurate Cycles Forecast for Major Markets

Andrew Pancholi’s Market Timing Report is consistently the most accurate cycles forecast there is for traders of major markets.

Peter Temple

Unmatched Expertise in Cycles Analysis

I’ve known Andrew for a number of years. He knows cycles better than anybody I’ve ever met, and I’ve studied cycles all my life.

Harry S. Dent, Renowned Forecaster and New York Times Best Selling Author

Essential for Success in Volatile Markets

The MTR is the most progressive way to make informed choices on how to position yourself even in the most volatile markets. The information and time cycles published are absolutely invaluable to our success.

We would recommend these services to any serious investor.

Daniel Malsbury, City Of London Markets